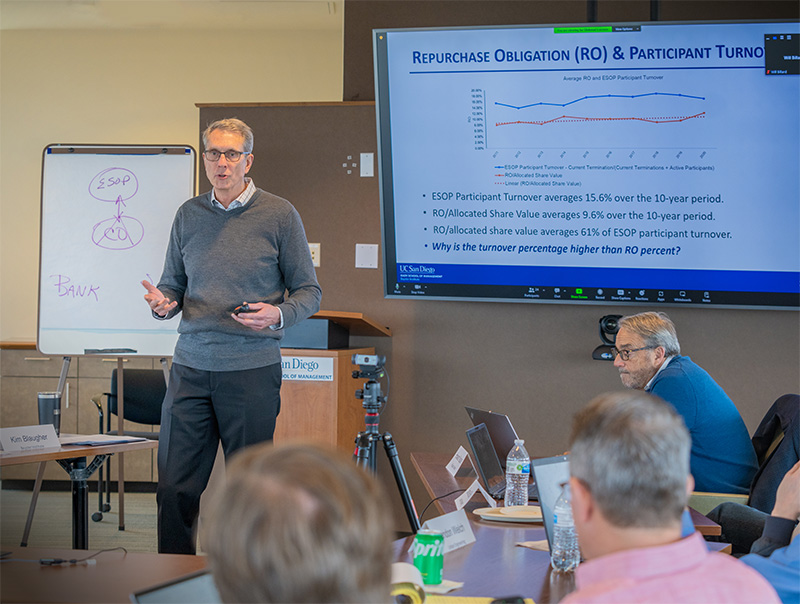

Advancing the Future of Employee Ownership

The Beyster Institute at UC San Diego’s Rady School of Management advances the understanding and practice of employee ownership as an effective and responsible business model.

Let us help you understand how employee-ownership can improve your business.

The Beyster Institute offers a wide range of services to help your company gain a deeper understanding of employee ownership. From consulting to training and educational resources, we are dedicated to providing the support and expertise needed to successfully implement and maintain an Employee Stock Ownership Plan (ESOP) or other types of employee ownership strategies.

-

Consulting

ServicesLearn how we help clients and their business achieve their goals.

-

Education

& TrainingBuild the necessary skills to run an employee-owned company.

-

Thought

LeadershipWe work together with key experts to advance the employee-ownership.

-

Articles

& PostsExplore additional Beyster’smaterials about employee-ownership.

What is an Employee Stock Ownership Plan?

An ESOP, or Employee Stock Ownership Plan, is a qualified retirement plan that annually allocates employer stock to eligible employees, and is almost always funded by the company. ESOPs provide substantial income tax benefits for the company, selling shareholders and employees.

ESOPs allow employees to participate in the equity value in the company they work with, and they are most often used as a tax beneficial succession planning tool by business owners to transfer the wealth of stock ownership to their current and future employees.

Why do shareholders choose to sell to an ESOP?

ESOP ownership can be a win for all stakeholders such as business owners, management, employees, and the company.

- The ESOP trust purchases, at a negotiated fair market value, the shareholder’s stock which is held in the trust for the employees’ benefit, allowing for a smooth transition of ownership, governance, management and company legacy.

- The shareholders can realize significant income tax benefits including deferring the gain on the sale of the stock to the ESOP trust.

- Management and employees can participate in the company and its stock growth, be part of a stronger culture, create a better working environment, enjoy more job stability, receive better wages, and many other benefits.

Ultimately, ESOPs allow companies to unlock the full potential of employee ownership to drive the company’s long-term success.