Career Impact: Master of Quantitative Finance

Gain Real-World Skills to Launch your Career in Finance

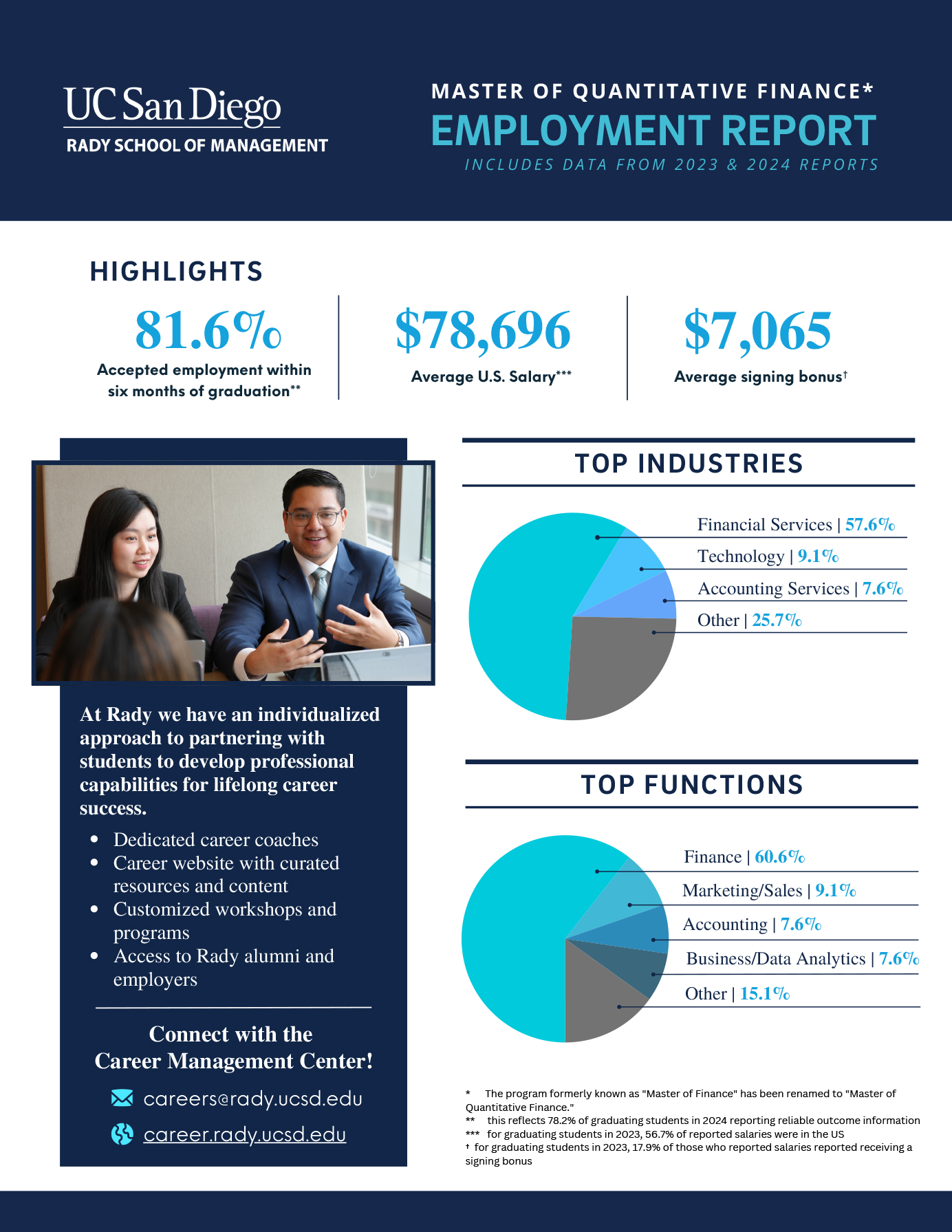

Through personal coaching, an array of programs and resources, and a commitment to creating access to opportunities, the Rady Career Management Center enhances your potential for success. A Rady School Master of Quantitative Finance graduate will be skilled at financial analysis and practical problem solving and ready to make significant contributions at investment institutions, insurance companies, regulatory and government agencies. Master of Quantitative Finance students receive ongoing career support from the Rady Career Management Center.

| 2024 MQF Employment Report |